Mr. Le Dinh Hien - Chairman of LHC Board of Directors said that the future of traffic

infrastructure of Lam Dong province and Da Lat city will have many big changes.

On April 20, Lam Dong Irrigation Investment and Construction Joint Stock Company (code LHC) held the 2025 Annual General Meeting of Shareholders, discussing many important contents.

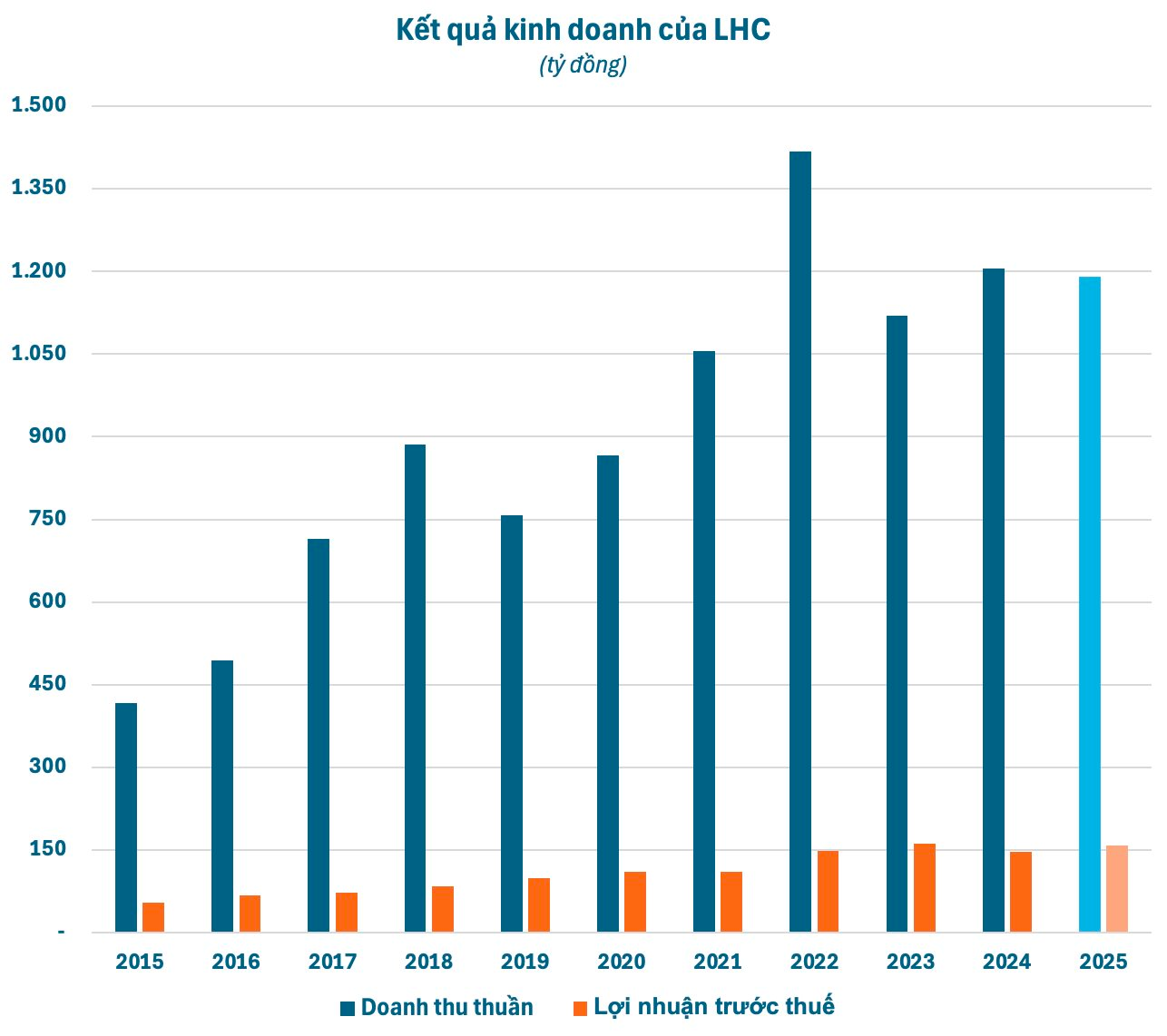

At the General Meeting, LHC shareholders voted to approve the 2025 business plan with a target of net revenue of VND 1,190 billion and pre-tax profit of nearly VND 159 billion, equal to 99% and 108% respectively compared to 2024. The 2025 dividend is expected to be 15-25%.

In 2024, LHC recorded net revenue of VND 1,229 billion, up nearly 10% over the same period last year. Profit after tax reached VND 117 billion, down slightly by nearly 6% compared to 2023. With the achieved results, the enterprise has exceeded the revenue plan by 12% and the profit plan for the whole year by 42%.

At the General Meeting, LHC shareholders dismissed two members of the Board of Directors, Mr. Ly Chu Hung and Mr. Phan Cong Ngon, at their request. Mr. Ly Chu Hung, representing a group of major shareholders from Taiwan (China), resigned after this group of shareholders withdrew their capital. Meanwhile, Mr. Phan Cong Ngon, an independent member of the Board of Directors, resigned for personal reasons.

At the same time, LHC shareholders elected Ms. Lam Boi Ngoc (representing the group of major shareholders) to the Board of Directors for the 2021-2025 term. Ms. Ngoc graduated with a Master's degree in Economic Law and International Trade, with many years of experience at enterprises such as Success Dragon Vietnam, FECON South, Bigtree, Legum NTN. In addition, Mr. Lam Vuong Hung was elected as an independent member of the Board of Directors.

During the discussion, LHC's board of directors answered many questions from shareholders.:

Share about future projects and company vision for the next 3-5 years?

Mr. Le Dinh Hien - Chairman of LHC Board of Directors said that in the next 3-5 years, LHC will not directly invest in any large projects but will increase the investment level for the Board of Directors from 150 billion to 250 billion, indirect investment.

At the General Meeting of Shareholders of Lam Dong Minerals and Construction Materials JSC (code LBM), shareholders approved the program of issuing shares to existing shareholders at a ratio of 4:1, equivalent to issuing 10 million shares, increasing charter capital to 500 billion. The issuance price is 15,000 VND/share, equivalent to the amount of revenue of about 150 billion. LHC holds more than 64% of LBM, needs 100 billion to buy issued shares of LBM.

LBM has equity at the end of 2024 of 613 billion, will mobilize an additional 150 billion plus retained earnings of about 800 billion. The company will borrow 400-500 billion from the bank to carry out material exploitation projects to supply the company's production system and sell to the market.

LBM recently won the auction for 3 material mines, including Can Treo/Duc Trong, Ninh Gia/Duc Trong, Tan Thanh/Lam Ha. However, these 3 mines are not enough and the company is still expanding its area to improve its capacity to supply construction materials for the company's projects and trade.

The mining auction and licensing processes are very complicated. LHC expects that in 2025, the National Assembly will amend the Mineral Law. LHC and LBM are in the group of common construction materials. It is expected that the licensing process will be amended in July 2025.

Currently, LHC is implementing the digitalization process for the entire system. According to the plan, a trial run will be conducted in the fourth quarter of 2025. If successful, it will be deployed throughout the entire LHC system and its direct and indirect subsidiaries by 2026. The company has also established a digitalization department and centralized management in the digital environment.

A shareholder expressed regret for not investing in LHC sooner. The reason given was that he could not find much information on the company's website. The shareholder suggested that the company improve its website infrastructure to update information promptly and fully for shareholders.

Chairman of the Board of Directors Le Dinh Hien said that LHC and its member companies still have two weak areas: IT and legal affairs. The IT department has just been established but has not recruited any staff yet. Mr. Hien regretted that he only now learned that the company's shareholders work in the IT field. LHC is building the entire IT system including the website, communications and sales.

Mr. Hien said that the legal department has been established but has not been able to recruit staff. LHC has to hire lawyers for each case. There are many legal difficulties with the work to be done. The projects are related to land and many planning areas. The company is trying to implement these two areas. Shareholders with expertise in consulting are very valuable.

In the near future, Lam Dong and Dong Nai will start construction on three expressway projects connecting Ho Chi Minh City with Da Lat. How will LHC participate in these projects, and what are their potentials and profits?

The Chairman of the Board of Directors of LHC said that the future of the transport infrastructure of Lam Dong province and Da Lat city will have many major changes. The Dau Day – Lien Khuong expressway project, Nha Trang – Da Lat expressway project, upgrading Lien Khuong airport, upgrading National Highway 28, shortening the distance from Gia Nghia to Bao Loc, etc. are about to start construction. Some projects are in the process of selecting investors, but these are large projects that are not within the scope of LHC..

However, LHC can do 2 things: 1 is a supplier, 2 is a subcontractor. There are no main contractors yet, so the subcontracting issue has not been discussed. To be a supplier, LHC has prepared for 5 years. The company has bought land to serve the Tan Phu intersection, adjusted the planning, leveled the ground, done paperwork, etc., but the license has not been completed.

Tan Phu – Bao Loc expressway interchange with 721, LJC is asking for permission to proceed with construction, concrete station, factory, available land. In Bao Loc, there will be an expressway interchange with National Highway 55, LHC already has the Tay Dai Lao quarry but its competitor has a quarry with a closer transport distance. LHC has built a station in Loc Son to reserve the Tay Dai Lao quarry, which has been in operation since the end of 2024, that is, before construction started.

The Chairman of LHC said that the company has been preparing for 5 years, hiding in key locations, when the project is launched, there will be opportunities to seize. Opportunities but also risks. Big investors have names but when touching their pockets, they do not see much money. The management perspective is not to turn money, raw materials into risks, debts, risks, frustrations, etc. The company's debt is often maintained around 60 billion. The risk of losing money for the company is also for shareholders. LHC regularly manages this.

On April 19, the whole country simultaneously started construction of 80 projects. LHC has 2 positions in the agricultural sector: Inauguration of Rach Moc Sluice - Soc Trang and Commencement of Rach Rua Sluice in Ho Chi Minh City, members of LHC are in the consortium.

LHC has invested in L40 and completed its divestment, then established L40.1 to retain assets and people to continue working in the construction industry. The company still has to handle all receivables, payables, audits and inspections until the end of 2024 and complete legal procedures to buy back the office. Use L40's bidding capacity within 5 years. The company is building capacity for L40.1, based on the capacity of the parent company and L40's remaining rights.

Regarding the proposal to cancel 1 article in last year's resolution on increasing the membership from 5 to 7 , LHC Chairman said that the Board of Directors considered it unnecessary. LBM's previous shareholders' meeting approved a reduction from 7 to 5. LHC currently has 4 major shareholder groups, so having 4 Board members and 1 independent Board member is reasonable.

Investment in LBM and L40 is highly effective. The remaining capital for irrigation construction of LHC has difficulties after the capital is invested. What is the solution to solve these difficulties?

Chairman of the Board of Directors Le Dinh Hien said that in the irrigation construction bidding, LHC has no difficulty in money and is very favorable. It is lending more than 50 billion to its subsidiary and still has more than 100 billion in its account. The company is lending in advance to invest in LBM, holding a 64.9% ratio at LBM. The company has no bank debt and is not overdue to partners.

Regarding the company name, LHC was equitized and started operating in August 2000, with a charter capital of 3 billion, and its main business is irrigation and hydropower. The company saw that the irrigation and hydropower market would run out of natural potential, so it had to change, leading to investment activities. The company prepared and started working nearly 20 years ago.

Since 2002, the chairman has worked with LBM and in 2003 LHC participated in buying LBM shares when the company was equitized. The chairman of LHC also became chairman of LBM when LHC held 5% of LBM. By 2014, LHC completed the acquisition of 51% of shares and became the parent company of LBM.

What are the advantages of LHC when borrowing?

Mr. Le Dinh Hien said that LHC contributed money to LBM to maintain the ownership ratio. The company is a big and good customer of the bank. Since its establishment, LHC has never defaulted on the bank's loan and has a very good relationship. If the expectation of 6 projects, including 3 projects won the auction and 3 projects being sought, is met, the capital needed is more than a thousand billion to implement. The mines now cost hundreds of billions, not as cheap as before. LHC will borrow about 400 billion to match LBM's 800 billion equity capital. If there are 3 more mines, it can borrow at a ratio of 1:1 with the shareholder's equity, no problem.

Regarding profit distribution, the development investment fund is allocated 15.8 billion, shareholders propose to leave it in undistributed profit, not to allocate to the fund?

LHC Chairman said that the proposal to adjust the dividend rate for 2025 is to save money for 2026 to distribute bonus shares at a ratio of 2:1 to increase charter capital.

After shareholders' questions were answered, the entire proposal was approved by shareholders with a high consensus.